You have the freedom to invest in whichever you select—stocks, bonds, mutual cash, plus more—as you possess all the assets in your brokerage account.

What if I have accounts elsewhere? Consolidating all your accounts at Schwab could help you improved manage your finances. We can help you each step of the way in which in bringing your property in excess of, within a tax-productive fashion. Find out more about transferring accounts to Schwab.

Entire funding Directions and use of online fund transfer resources are going to be presented following your account is opened.

five. Please see the Charles Schwab Pricing Tutorial for comprehensive information on fairness and options commissions. Various-leg alternatives procedures will involve a number of commissions. Solutions have a higher level of threat and so are not well suited for all investors.

Electronic funds transfer (EFT) with Schwab MoneyLink® to transfer cash or assets from an exterior account. You may also frequently fund your account by starting car deposit to transfer funds from your checking account.

A money account only helps you to make use of the money which you deposited to buy stocks, bonds, mutual money, or other investments. Such a account presents fewer industry hazard as you might be only investing assets you already have, but might be restricting when well timed options or emergencies arise.

Open an individual account : opens in a new window Open a joint account : opens in a fresh window online fairness trades $0

Solutions have a higher amount of possibility and they are not ideal for all investors. Specified necessities needs to be met to trade choices through Schwab.

4. Requires a wireless signal or cell relationship. Procedure availability and reaction times are issue to current market disorders and cell link restrictions.

Can I trade possibilities in my account? It's essential to be approved to be able to trade alternatives in the Schwab brokerage account. Over the online application method, you are able to choose to add solutions buying and selling and make an application for a single of 4 levels of acceptance based upon your aims, expertise, and financial position.

What's the minimal deposit to open up a brokerage account? There is absolutely no minimal investment needs to open a brokerage account.

Nonetheless, margin borrowing is just not for everyone, and you also should take into account all challenges and limits right before deciding upon this feature. Understand almost everything you need to know about margin financial loans While using the Schwab Manual to Margin.

What's a brokerage account? A brokerage account is definitely an arrangement between you in addition to a certified brokerage firm. At the time your account is about up, you are able to deposit cash and spot investment orders through the brokerage account, and the transactions might be carried out on your behalf.

What is the difference between a margin account along with a income account? A margin account lets you borrow in opposition to your qualified securities and may be helpful when you should acquire a lot more securities, reap the benefits of timely industry options, or give yourself a source of overdraft safety.

Refund requests has to be obtained inside ninety days of the day the payment was billed. Schwab reserves the appropriate cisco investments blog to alter or terminate the guarantee Anytime. Head to schwab.com/satisfaction to know what's bundled And the way it really works.

Useful Url's

https://www.dailyfx.com

Jake Lloyd Then & Now!

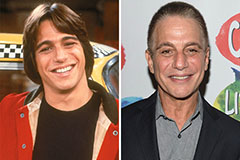

Jake Lloyd Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Michael Oliver Then & Now!

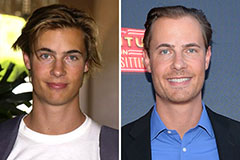

Michael Oliver Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now!